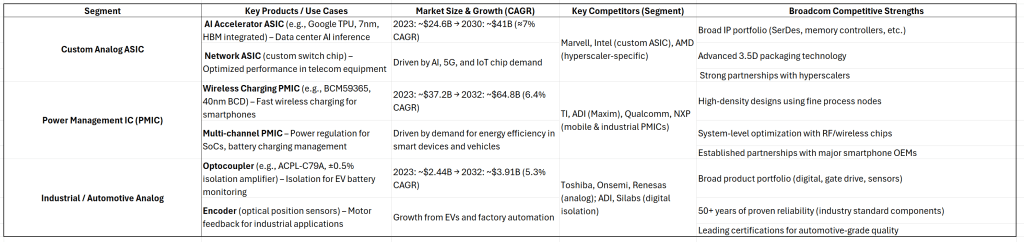

Broadcom (AVGO) designs and supplies a wide range of analog and mixed-signal chips, particularly excelling in the fields of custom analog ASICs, power management ICs (PMICs), and analog components for industrial and automotive applications.

This report analyzes each segment from an investment perspective: key products and applications, market outlook, major customers and industries, competitive landscape and Broadcom’s strengths, revenue contribution, and future strategies.

Custom Analog ASICs

Key Products and Applications

Custom analog ASICs are application-specific integrated circuits tailored to particular customers or use cases. Broadcom possesses industry-leading capabilities in high-performance custom SoC ASIC design, allowing the creation of differentiated chips tailored to customer needs. These ASICs are used in telecom network equipment, data center switches/routers, AI accelerators, and specialized smartphone chips. For example, Broadcom utilizes its TSMC 7nm process-based custom ASIC platform to integrate high-speed 112G PAM-4 SerDes interfaces, HBM2/3 high-bandwidth memory PHYs, and mixed-signal IP to develop deep learning accelerator and networking ASICs. These customized chips deliver performance and power efficiency optimized for specific functions compared to general-purpose processors, helping differentiate customer systems.

Notably, Broadcom has co-developed over 10 generations of AI ASICs with Google since 2014, such as TPU chips incorporating specialized logic and ultra-high-speed interconnects for AI workloads used in data centers.

Market Demand and Growth Outlook

The custom ASIC market is rapidly expanding with the spread of technologies such as AI, 5G, and IoT. Demand for specialized chips is increasing across industries to overcome the limitations of general-purpose solutions. The ASIC market was valued at approximately $24.6 billion in 2023 and is projected to grow to $41 billion by 2030—a solid CAGR of around 7%. Key growth drivers include AI computing acceleration, explosive growth of IoT devices, and deployment of 5G infrastructure.

Custom analog/mixed-signal ASICs are essential for high-speed signal processing, sensor interfacing, and power management, which also drives demand in automotive electrification and industrial automation. Hyperscale data center operators are increasing investments in custom AI ASICs (as alternatives to GPUs), and Broadcom is collaborating with major customers to meet this demand. Broadcom management even highlighted custom ASICs as a $60–90 billion opportunity by 2025, positioning it as a core pillar of the company’s future growth.

Major Customers and Industries

Broadcom’s custom ASIC customers include large tech firms and telecom equipment manufacturers. Hyperscalers such as Google, Microsoft, Amazon, and Meta are collaborating with Broadcom to develop AI accelerator ASICs (XPUs), emerging as alternatives to Nvidia GPUs. Broadcom has established trust with Google by co-developing and supplying multiple generations of TPUs (Tensor Processing Units).

Broadcom also supplies custom switch/router ASICs to networking companies like Cisco, playing a critical role in high-performance telecom equipment. In the smartphone market, Broadcom has reportedly developed customized chips optimized for functions like wireless charging control and touch controllers for key clients such as Apple.

In industrial and automotive fields, Broadcom designs and supplies dedicated analog front-end chips required by large OEMs and Tier 1 suppliers. Examples include analog ASICs for vehicle LiDAR sensors or customized interface chips for factory automation systems, supported by Broadcom’s extensive IP portfolio. Overall, major demand sources include data centers/AI, telecom infrastructure, high-end mobile devices, and industrial/automotive electronics.

Competitors and Broadcom’s Competitive Edge

Competitors in the custom ASIC market include Marvell, Intel (custom foundry/ASIC division), and AMD (via Xilinx-based ACAP). Marvell is increasing its share in custom chips for cloud clients, but Broadcom maintains a competitive edge through years of IP accumulation and end-to-end solutions. With a vast IP library including high-speed SerDes interfaces, HBM integration, TCAM/SRAM embedded memories, and ARM core IPs, Broadcom can rapidly build custom chips to meet client demands.

For instance, networking ASICs requiring high throughput can integrate 112Gbps PAM4 SerDes with ultra-low-latency switching fabrics, while AI accelerator ASICs can be co-designed with large HBM2E memory stacks for one-stop integration. Broadcom is also a leader in packaging. In 2024, it launched a 3.5D stacked packaging platform (XDSiP) that stacks multiple chiplets into a high-performance module. This enables high density and signal integrity versus competitors—customers can fit over 6000 mm² of silicon and up to 12 HBM stacks in a single package, enhancing performance for AI/HPC ASICs.

Broadcom’s comprehensive capabilities (design IP + manufacturing partnerships + packaging technology) create a strong barrier to entry. As a networking leader, Broadcom provides switches, NICs, and interconnects alongside ASICs, offering system-level optimization. This total solution capability is a differentiator in the custom ASIC space.

Profitability and Revenue Contribution

The custom ASIC business has become a key growth engine in Broadcom’s semiconductor segment. In FY2024, Broadcom’s revenue from AI and custom ASICs surged to $12.2 billion—more than doubling YoY—and now accounts for a significant share of overall revenue. The increase was driven by growing AI ASIC shipments from collaborations with clients like Google, helping Broadcom reach a $1 trillion market cap in 2024.

While custom ASICs require high NRE (non-recurring engineering) investments, once supply begins, they offer stable, high-margin revenue through long-term contracts. Broadcom has an ASIC roadmap confirmed with at least three hyperscaler clients over the coming years, securing predictable revenue flows.

In contrast to its prior analog businesses (including industrial/automotive), which accounted for just 5% of revenue, custom ASICs have grown to double-digit percentages of semiconductor sales, fueled by the data center and AI boom. The high growth and profitability help maintain Broadcom’s semiconductor EBITDA margin in the mid-to-high 60% range.

From an investment standpoint, Broadcom’s ASIC business is seen as a core area delivering both strong future growth and profitability.

Future Technology or Strategic Investment Directions Broadcom plans to continue its technology leadership and strategic alliances in the custom ASIC space. On the technology front, the company is transitioning to 5nm and 3nm processes to enhance performance and efficiency, and is commercializing the aforementioned 3.5D chiplet-based packaging for large-scale ASICs.

For example, with innovations like Face-to-Face (F2F) stacking, Broadcom aims to increase chip-to-chip interconnect density by 7x and power density by 10x. Broadcom invests over $3 billion annually in ASIC R&D and is strengthening co-development partnerships with hyperscalers. Besides Google, it is solidifying its role as a custom AI chip partner to Meta, Microsoft, and AWS, and focusing on next-gen optical-electrical integration ASICs for telecom equipment.

Strategically, Broadcom is also expanding its IP portfolio through small design house acquisitions or IP licenses as needed. From a customer engagement standpoint, Broadcom aims to move beyond simple chip supply and become a co-design partner from early development stages—building long-term, exclusive client relationships.

In summary, Broadcom’s custom analog ASIC division is expected to remain an industry leader through a combination of cutting-edge process technology, advanced packaging, broad IP, and strategic client alliances.

CONQUER THE MARKET, VAZ INVESTMENT RESERACH.

Leave a comment