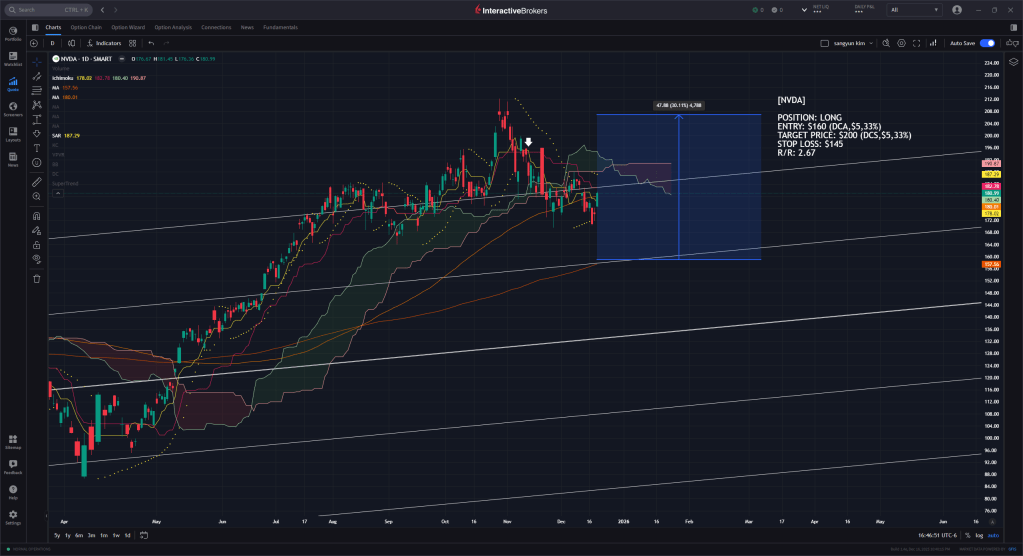

Technical Setup & Strategic Entry Point

Trade Strategy

- POSITION: LONG

- ENTRY: $160 (DCA,$5,33%)

- TARGET PRICE: $200 (DCS,$5,33%)

- STOP LOSS: $145

- R/R: 2.67

Technical Rationale

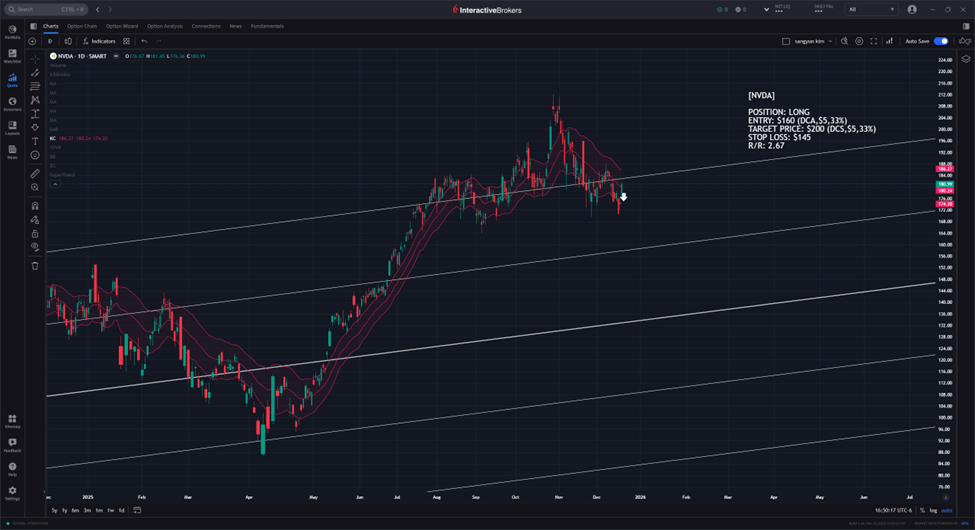

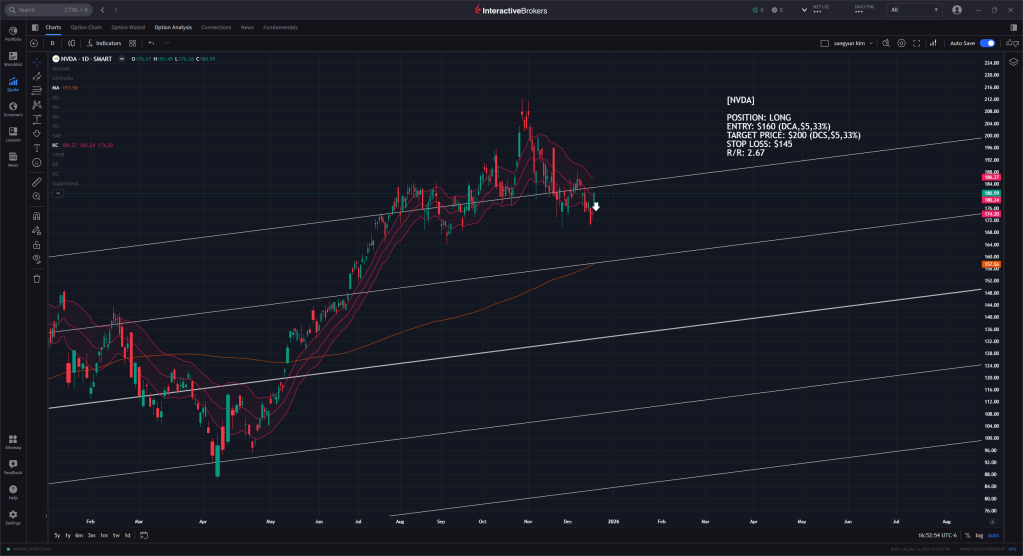

- Keltner Channel Alignment

- The price is currently hovering near the lower bound of the Keltner Channel. Historically, this zone has served as a temporary exhaustion point for selling pressure, suggesting a potential bounce or consolidation.

- Confluence of Support ($160 Range): The most compelling entry zone lies around $160. This level represents a significant technical “confluence” where:

- The 200-day Moving Average (MA) provides a long-term psychological and technical floor.

- The medium-term ascending trendline (lower boundary of the parallel channel) intersects, reinforcing the structural support.

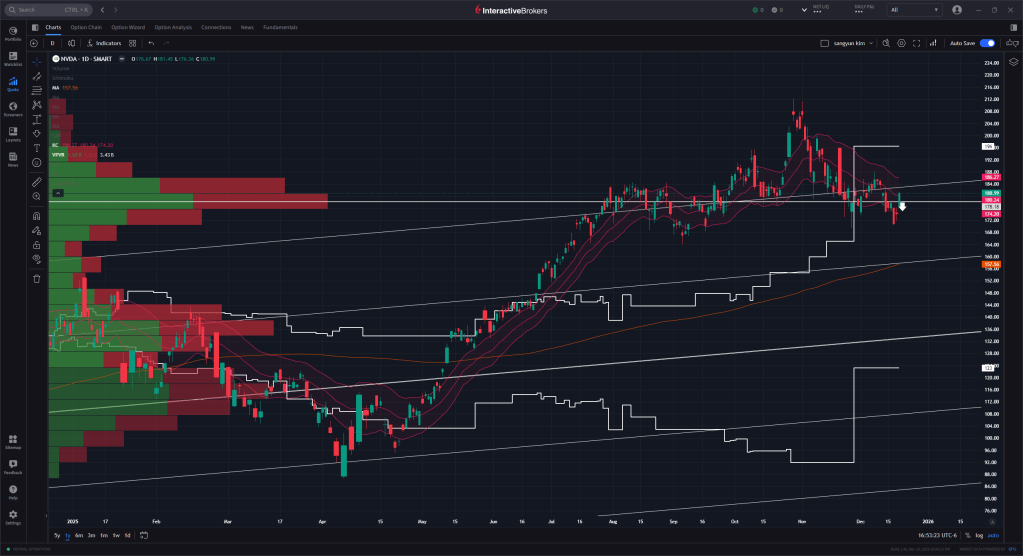

- Volume Profile (VPVR): The $155 – $165 zone shows a high volume of historical transactions, indicating a strong interest from buyers that could act as a safety net.

Thesis Invalidation

- Hypothesis Cancellation:

- If the price rallies and reaches $190 before hitting our $160 entry zone, the current hypothesis will be discarded.

- A move to $190 without the corrective dip would suggest a change in immediate market structure.

Leave a comment