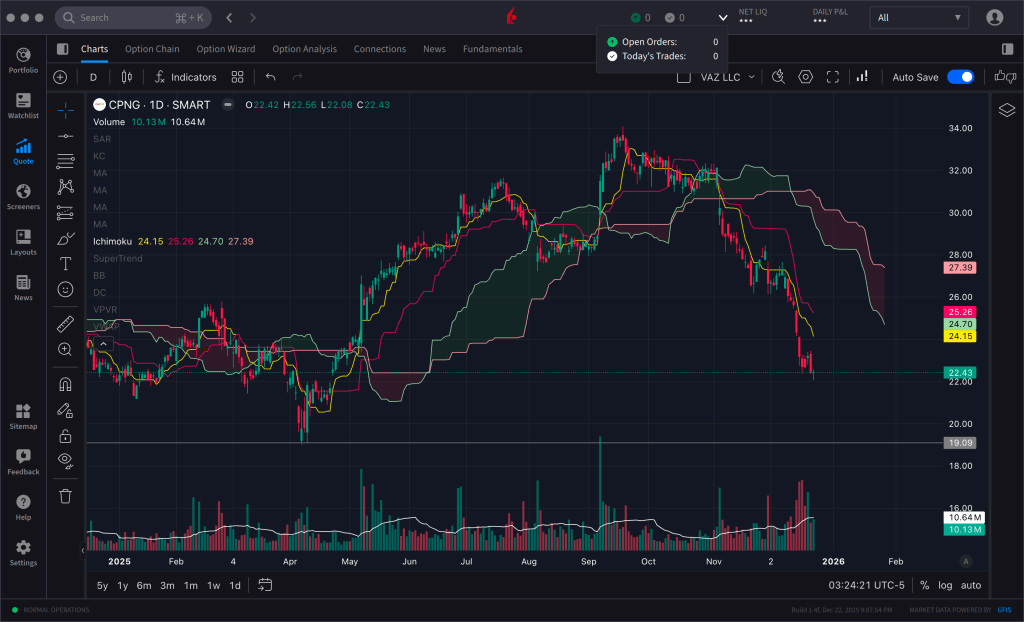

COUPANG INC.

[POSITION] LONG

[STRATEGY] DCA, 5% INTERVALS, 4 TRANCHES (25%)

[TIME HORIZON] 6MOS

[LAST] $22.43

[TARGET BUY ] TP1: $20.00, TP2: $19.00, TP3: $18.05, TP4: $17.15

[TARGET SELL ] TP 1: $25.00, TP2: $26.25, TP3: $27.56, TP4: $28.94

Investment Thesis

1/ CPNG has established a 6-month support level at $19.09.

2/ Although the bullish trend initiated in January persists, a cooling period in buying volume—observed over the last five trading days since Dec 17—indicates the stock is finding a floor.

3/ A Stochastic reading of 6.27 points toward a technical oversold condition. Looking ahead, a move toward the upper Keltner band at $26 is a plausible 6-month target.

4/ With the ticker still trading below the bearish cloud, immediate upside momentum remains limited.

5/ A disciplined DCA (Dollar Cost Averaging) strategy near the $20 mark is recommended, maintaining a longer-term perspective.

Thesis Invalidation

If OBV breaks below -75M, I will consider the medium-term momentum lost and the investment thesis invalidated.

DISCLAIMER: THIS ANALYSIS IS FOR EDUCATIONAL PURPOSES ONLY AND NOT FINANCIAL ADVICE. ALL INVESTMENT DECISIONS MUST BE MADE INDEPENDENTLY AFTER CONSULTATION WITH A LICENSED FINANCIAL ADVISOR. TRADING STOCKS INVOLVES SUBSTANTIAL RISK OF LOSS. THERE IS NO GUARANTEE OF PROFITS. PAST PERFORMANCE DOES NOT INDICATE FUTURE RESULTS. VERIFY ALL DATA INDEPENDENTLY BEFORE EXECUTING ANY TRADES.

℣

Leave a comment