1. Macro Overview

United States: The U.S. economy shows mixed signals. Inflation has moderated by some measures – core PCE for February was around 2.7% year-on-year – but inflation expectations have jumped amid new trade policy fears. Consumer surveys reveal rising expected inflation (back above 6% for the first time since 2023) and increasing recession worries. The Federal Reserve remains vigilant; a Fed official even warned that tariff-driven price increases may not be transitory. On the growth side, manufacturing is softening (ISM PMI expected <50), and consumer confidence has slipped. Overall, the Fed is likely on hold for now, balancing still-elevated core inflation against signs of cooling demand and high uncertainty.

Europe: Growth in Europe remains subdued but is poised to get a short-term lift from fiscal expansion. Germany has broken from its austerity stance – the German senate just approved a special infrastructure fund and a defense-spending debt rule exemption, amounting to an extra €90 billion over 10 years. This could raise Germany’s GDP growth by an estimated ~0.6 percentage points (and +0.19 pp for the Eurozone) in the coming years. In the near term, that infrastructure push (roads, energy, transport) – about 1.6× the usual annual infrastructure budget – should boost jobs and demand. Eurozone inflation, meanwhile, has fallen closer to target (March CPI ~2.3% YoY), which, combined with slow growth, suggests the ECB will maintain a pause on rate hikes. However, structural challenges persist (aging workforce, lost manufacturing edge), so Europe’s longer-term outlook depends on productivity reforms even as fiscal policy turns supportive.

China: China’s post-reopening recovery appears uneven. Official PMIs for March hover just above 50 (Manufacturing ~50.4, Non-manufacturing ~50.6), indicating tepid expansion. Policymakers in Beijing are likely to maintain accommodative measures to solidify the recovery. Notably, Chinese equity markets have been resilient – major Chinese tech stocks have rallied strongly since the start of the year – reflecting improved domestic sentiment. This has narrowed the market-cap gap between Chinese tech giants and global peers. However, exports face headwinds from renewed trade tensions and U.S. tech restrictions. The recent U.S. tariff threats and semiconductor embargoes create uncertainty for China’s manufacturing outlook. Overall, China’s growth is stabilizing at a moderate pace, with internal consumption improving but external demand and the property sector still lagging.

Korea and Japan: In South Korea, political uncertainty has been a key theme. A series of domestic political events (including an impeachment trial of the prime minister and other turmoil) has injected volatility. This instability, however, has accelerated calls for fiscal stimulus. A large supplementary budget (“추경”) on the order of ₩20 trillion is now considered almost a given. Such a stimulus (nearly 1% of GDP) is expected to bolster growth, but it has also put upward pressure on Korean government bond yields in anticipation of increased issuance. The Bank of Korea is expected to hold rates steady at its April meeting, prioritizing financial stability amid these political and fiscal developments. Even with the won depreciating on domestic uncertainty, the BoK has indicated it needs time before considering any rate cuts.

In Japan, the economy is gradually emerging from stagnation. Inflation is modestly above target (Tokyo CPI ~2.7% YoY in March), but the Bank of Japan remains extremely accommodative. The BOJ’s ultra-loose policy (only lightly adjusted in late 2024) continues under new leadership, aiming to secure a lasting rise in wages. The Japanese yen, after a long depreciation, has recently firmed as global investors seek safety – a reminder of its safe-haven status. Geopolitical risks (like tariffs) have actually buoyed the yen and highlighted Japan’s role as a relatively stable market. Japanese exporters could face headwinds if global trade frictions escalate, but domestically the cheap yen and fiscal support (via stimulus from the Kishida administration) are providing a backstop to growth.

Emerging Markets: Broader emerging markets are navigating a challenging cross-current of global factors. On one hand, many EM economies are benefiting from peaking global interest rates – several earlier crisis-fighters (e.g., in Latin America) have started cutting rates as inflation there cools. This monetary easing cycle in select EMs should support their growth trajectories later in 2025. On the other hand, EM countries that are export-driven (especially in Asia) are vulnerable to the U.S.-China trade conflict. Trade uncertainty is already dampening business sentiment across manufacturing hubs. Taiwan and South Korea (often grouped with EM Asia) are seeing semiconductor demand fluctuate with the U.S.-China tech spat. Additionally, a strong U.S. dollar this past year tightened financial conditions for many EM nations, though recently the dollar has softened somewhat (the DXY index is down ~3% in March). Commodity-exporting EMs have enjoyed stabilizing or rising commodity prices until recently, but global growth fears could cap further commodity gains. In summary, emerging markets are a mixed bag: domestic demand in large EMs like India remains robust, and easing inflation is giving policymakers room to stimulate, but external risks from trade wars and slower developed-market growth warrant caution.

2. Stagflation Issue

There is growing debate about stagflation – the unwelcome combination of stagnant growth and persistent inflation – particularly in the United States. Recent data raises some warning flags. Consumer sentiment has weakened significantly: the Conference Board’s confidence index fell more than expected, and the University of Michigan survey hit low levels. Importantly, inflation expectations have spiked. The Michigan survey’s short-term inflation expectation jumped back into the 6%+ range, the highest in about 9 months. Households are clearly feeling the pinch of rising prices and are increasingly worried about a potential recession. In fact, the share of consumers expecting a downturn is at a multi-month high. Such pessimism, if sustained, can become self-fulfilling by cooling spending.

At the same time, price pressures remain elevated. Even though official inflation readings for February came in a bit softer than anticipated (both CPI and PPI were below forecasts), underlying trends bear watching. Core price indices are still rising at a pace above target. Crucially, forward-looking measures are flashing concern: breakeven inflation rates (market-implied expectations) have been climbing. This suggests investors see higher inflation ahead, possibly reflecting factors like new tariffs, commodity costs, or wage pressures. The St. Louis Fed President noted that the inflation impact of tariffs might not be “just temporary,” implying that protectionist policies could embed a more persistent price level increase. Indeed, the prospect of broad U.S. import tariffs (set to be announced April 2) is adding an inflationary risk on top of existing trends – tariffs function effectively like a tax on imports, which could raise consumer prices over time.

Meanwhile, growth signals are softening, hence the “stag” part of the equation. Higher-frequency data shows a loss of momentum. March’s consumer confidence and spending data were lackluster. Soft data (surveys and sentiment) has turned down ahead of the hard data: PMI indices hinted at slowing activity, and the Conference Board’s index showed consumers starting to pull back. On the manufacturing side, orders and output have been mediocre for months. Real consumer spending had been a relative bright spot (helped by excess savings and job growth), but there are signs that inflation is eroding purchasing power. Rising delinquency rates and weaker retail sales imply consumers’ ability to spend is gradually getting crimped. If upcoming data on personal consumption expenditures (PCE) confirm a slowdown (once price effects are stripped out), it will underscore the stagflation risk: slower real growth coupled with sticky inflation. In effect, tariff-driven price increases alongside cautious consumers is a recipe for stagflation, and that concern is evident in both surveys and bond markets.

Policymakers are acknowledging this precarious balance. The term “stagflation” is resurfacing in economic commentary and Fed speak. The Fed, while not explicitly forecasting stagflation, is in a bind: inflation is above their comfort level, yet aggressive tightening could deepen a growth slowdown. For now, the base case is not a repeat of 1970s-style stagflation – inflation is lower and more stable than that era – but the risks have risen. Should the tariff measures proceed and add to price levels, the Fed may find itself stuck between needing to support growth or quell inflation. Investors are increasingly hedging against this scenario; for example, TIPS breakeven rates are climbing (pricing in higher inflation), even as yield curves remain inverted (a sign of growth pessimism). In short, while a full stagflation isn’t here, elements of it (subpar growth and lingering inflation) are emerging in the U.S. and even parts of Europe. Continued vigilance is warranted: if inflation expectations become unanchored while growth stalls, central banks could be forced into very tough choices.

3. 4/2 Tariff Policy Expected Impacts

All eyes are on the Trump Administration’s April 2 “reciprocal tariff” announcement and the related trade measures. Investors are actively debating the potential market fallout, with markedly bullish vs. bearish takes:

- Bullish Perspective: Some market strategists and investors believe the tariff announcement could actually reduce uncertainty, allowing equities to rally. Their argument is that the trade war’s “worst-case” scenario is already priced in, and clarity on policy will let businesses and investors plan ahead. In fact, merely scheduling the announcement has been seen as a step toward resolving ambiguity – financial markets have been evaluating the move positively, noting that just announcing concrete tariffs may free markets from their biggest overhang. President Trump himself has hinted that many countries could receive exemptions or negotiate adjustments. Indeed, recent signals suggest flexibility: for example, Trump indicated tariffs will be applied “very generously” and is open to negotiations if the U.S. can gain something. This has led bulls to expect that the actual measures might be less harsh than feared. Tom Lee (Fundstrat) is a prominent voice in this camp, arguing that a relief rally is likely once details are out – he notes that if numerous trading partners are exempted or strike deals, the global economy avoids worst-case damage, and pent-up investor demand could trigger a “face-ripping” stock rebound after April 2. Likewise, a global strategist at a major Asian brokerage shares the view that negotiations will ultimately prevail, seeing the tariffs as a bargaining tool that will lead to concessions from trade partners rather than a prolonged trade war. Bullish investors also point out potential beneficiaries: U.S. domestic industries might gain an edge if foreign competitors face levies, and import-competing sectors (like some steel or aluminum makers, and U.S. auto manufacturers focusing on the home market) could see a boost. More broadly, if the announcement is in line with expectations (no big surprises), it could mark the peak of trade uncertainty – an environment in which equities often rally as investors breathe a sigh of relief. In short, the bullish case is that April 2 will be a “liberation day” from trade uncertainty, removing a major risk and allowing the market’s focus to shift back to solid fundamentals (like tech innovation and consumer spending) after an initial bout of volatility.

- Bearish Perspective: On the other side, many are bracing for a negative shock to markets and the economy. The bearish view emphasizes that new tariffs – especially if broad-based – act as a tax on commerce, raising costs and denting growth. If Trump follows through with aggressive measures (e.g. a blanket tariff on all countries, or the full 25% auto import tariff with no exceptions), it could ignite a full-fledged trade war. Investors with this view note that markets have already shown sensitivity: when the 25% tariff on imported autos (starting April 3) was officially confirmed, global stocks dropped for consecutive days. Trade-sensitive sectors are reacting sharply. Automotive stocks globally sold off on the news (major automakers in Asia and Europe fell 3–5% in one day). Semiconductor stocks have also been hit: the U.S.-China tech conflict is widening, and China’s recent moves to tighten regulations on tech (and comments about a potential AI investment bubble) caused U.S. and Korean semiconductor shares to wobble. These sectoral impacts show how tariffs can reverberate through supply chains – autos, chips, and even pharmaceuticals or lumber are all in the crosshairs. Bears also highlight that the effective U.S. tariff rate is set to jump dramatically. Surveys suggest the market expects an average reciprocal tariff of ~9%. If implemented on key countries that make up the bulk of U.S. imports, that could push the average U.S. tariff burden to its highest since the 1940s. Such a shift would raise costs for importers and potentially for consumers, acting as a drag on spending and corporate margins. There is also the risk of retaliation: while some U.S. allies are looking to appease Washington (e.g. the UK and India considering lowering their digital taxes, Korea announcing major investments in the U.S. to avoid ire), other countries may retaliate with their own tariffs. Even a limited tit-for-tat response could hurt U.S. exporters (farmers, aerospace, etc.) and global trade volumes. Beyond the direct economics, bears focus on uncertainty – the announcement might be just the start of protracted negotiations and periodic escalations. That ongoing uncertainty can itself dampen business investment and hiring. Early evidence of this is seen in surveys: businesses have cited trade policy as a reason for delaying capital expenditures. In sum, the bearish camp warns that the 4/2 tariffs could increase recession risks (by hammering global supply chains and confidence) and keep market volatility elevated. They note that policy uncertainty may not diminish immediately – even after April 2, questions will remain about implementation timing, which countries/products are hit or exempt, and how long any “trade truce” may last. Until those are answered, they expect a risk-off stance to prevail, with investors favoring safe havens over equities.

It’s likely that market volatility will spike around the announcement as these two perspectives battle it out. In the very short term, caution is warranted; we could see fast swings in stock indexes and currency values in early April. Key sectors to watch include: Automotive (global auto manufacturers and parts suppliers – extremely sensitive to the 25% U.S. auto tariff), Technology/Semiconductors (any sign of tech supply-chain disruptions could further pressure chipmakers), Industrials (machinery and aerospace, especially if there are retaliatory moves), and Agriculture (if U.S. trading partners target farm goods in response). Market sentiment will hinge on the fine print of Trump’s plan. If the announced tariffs are close to what was telegraphed (and come with potential off-ramps via negotiation), we may see an initial selloff followed by a relief rally. However, if the measures surprise to the upside (in magnitude or scope) or if major economies react tit-for-tat immediately, a risk-off tone could dominate for longer. Investors should be prepared for whipsaw moves, but also keep an eye on opportunities – policy clarity, even if the news is bad, can sometimes mark a turning point where the removal of uncertainty sparks a relief rebound.

Finally, it’s worth noting the geopolitical dimension: this trade stance is part of a broader U.S. strategy of “America First” economics. Over time, it may drive supply chains to reorganize (benefiting some emerging markets as alternate suppliers while hurting others). Trade tensions are also pushing affected countries (e.g. in Europe and Asia) to consider more stimulus to cushion their economies – for example, Germany’s fiscal loosening was partly aimed at offsetting external headwinds. In that sense, the 4/2 tariff policy could have complex second-order effects on global growth and policy responses well beyond the immediate market reaction.

4. Other Economic Issues Worth Watching

In addition to trade policy, investors should monitor several key economic releases and policy events in the coming week that could move markets:

- U.S. PMI Surveys: The ISM Manufacturing PMI (Mar) is due April 1, with consensus around 49.8 (down from 50.3), indicating a mild contraction in factory activity. Likewise, the ISM Services PMI (Mar) on April 3 is expected at roughly 53.1 (slightly lower than 53.5 prior). These will reveal whether the economy’s momentum is slowing across sectors. Particularly, a sub-50 manufacturing reading would confirm an industrial slowdown, while services remain expansionary but could be cooling. Markets will react if these PMIs surprise significantly, as they gauge business sentiment amidst the banking and tariff uncertainties.

- U.S. Labor Market Reports: A raft of labor data will shed light on employment trends. The March ADP private employment report (Apr 2) is forecast to show about +119,000 jobs (versus +77k prior) – a soft figure compared to recent averages, reflecting hiring caution. More critically, the March nonfarm payrolls report (due Friday, Apr 4) is expected to show a gain of roughly +120k to +135k jobs, a deceleration from February’s +151k. The unemployment rate is projected to hold around 4.1–4.2%, and average hourly earnings growth around 3.9% YoY (just a tick below the previous 4.0%). Investors will be watching how much the job market is cooling – any major downside surprise in payrolls could amplify recession fears (and conversely, any upside surprise could ease them, but also complicate the Fed’s task). Additionally, the JOLTS job openings (Apr 1) will be scrutinized for signs that labor demand is cracking; openings are expected to edge down from ~7.74 million previously. Given the Fed’s focus on labor tightness, these reports are pivotal.

- Inflation Data: Several inflation readings globally could influence policy expectations. In Europe, the Eurozone March CPI (Apr 1) will be released, with consensus at 2.3% YoY. A softer-than-expected print could reinforce the narrative that inflation is finally tamed in Europe, possibly giving the ECB more room to stay dovish, whereas a higher print (especially in core inflation) might rekindle tightening talks. Also, South Korea’s March CPI (Apr 2) is expected around 2.0% YoY – important because Korea’s inflation hitting the BoK’s target may justify their rate pause. These, along with country-specific data (e.g. Turkey’s inflation or Brazil’s IPCA if due), will be watched by EM investors. In the U.S., the PCE price index for February will just have come out (an important Fed gauge), but the next major U.S. inflation reading (CPI) is further out in April. Still, markets will pay attention to any clues on price trends from PMI price sub-indices or consumer surveys during the week.

- Chinese Economic Releases: China’s outlook will be updated with March PMI figures. The official NBS Manufacturing and Non-Manufacturing PMIs (Mar 31) are expected at 50.4 and 50.6 respectively, essentially flat but in expansion territory. Also, the private Caixin Manufacturing PMI (Apr 1) is forecast ~50.6, and the Caixin Services PMI (Apr 3) at ~51.6. These PMIs will signal whether China’s economic recovery is gaining momentum or stalling. Investors will especially focus on new orders and export orders components given global demand concerns. A stronger PMI could boost commodity currencies and emerging markets, while a miss might raise concerns about global growth. Additionally, any announcements from China’s politburo meeting (if any) or updates on stimulus measures (such as special bond issuance for infrastructure) would be noteworthy.

- Central Bank Actions: While the Fed and ECB are in between meetings, we do have the Reserve Bank of Australia (RBA) policy meeting on April 1. The RBA is expected to hold rates at 4.10% (the current cash rate) as Australian inflation has shown signs of peaking. Still, the tone of the RBA’s statement will matter – any dovish hints of a future cut (given global uncertainties) could weaken the Aussie dollar and lift Aussie bonds. Conversely, if they surprise with a hike or a hawkish stance due to domestic inflation, it could jolt local markets. Elsewhere, no major G-7 central bank meets this week, but keep an eye on any Fed speakers or ECB commentary at conferences – with volatility returning, officials may make unscheduled remarks. In emerging markets, a few central banks (e.g. India’s RBI or others) have meetings in early April; guidance from those will be watched for the EM policy trajectory (many are nearing a peak or starting easing cycles). Lastly, although not strictly an “economic release,” any progress on the U.S. budget/debt ceiling talks (as Congress returns from recess) could creep into market consciousness, since the debt ceiling deadline looms in coming months. Geopolitical events – notably OPEC’s monitoring of oil prices or any Russia-Ukraine developments – also bear watching, as they can indirectly affect inflation and sentiment.

In summary, the coming week is packed with data. Manufacturing/PMI figures will tell us if the industrial slowdown is deepening globally. Labor metrics will confirm if the job market is finally loosening meaningfully. Inflation prints will indicate how quickly central banks can relax. And all of this unfolds against the backdrop of the major tariff announcement on April 2. Investors should be prepared for data-driven swings: positive surprises (e.g. strong China PMIs or very weak inflation) could mitigate some trade-war angst, while weak data or hotter inflation could exacerbate the cautious mood.

5. Weekly Investment Strategy

Macro Positioning: Given the current environment, our short-term strategy is to remain cautiously positioned at the start of the week, with a plan to pivot more risk-on if the trade policy outcome is benign. In practical terms, this means maintaining a slightly defensive stance heading into the April 2 tariff announcement – a bit more cash or short-term Treasuries than usual, and hedges in place – but also being ready to add equity exposure on any significant dips or once policy clarity emerges. We favor the U.S. over other regions in the near term. The rationale is that the U.S. economy, while slowing, is still more resilient than Europe or emerging markets, and historically in trade conflicts the U.S. often sees less immediate damage than export-dependent economies. Analysts expect that for the coming weeks the downside risk is larger for non-U.S. markets than for the U.S. As such, we recommend an overweight in U.S. equities relative to international equities for the week ahead. Within global allocations, consider tilting away from regions most exposed to the tariff fallout: for example, be cautious on Europe and Northeast Asia (Japan/Korea) in the very short run, as their automakers and capital goods producers face direct pressure. In contrast, U.S. equities have sold off somewhat on tariff fears already, and could stabilize sooner if uncertainty lifts. We also maintain a modest overweight in investment-grade bonds, especially U.S. Treasuries, as a hedge – if growth worries deepen, bonds should rally (yields fall), cushioning the portfolio. With stagflation concerns bubbling, inflation-protected securities (TIPS) or commodities can be considered, but over a one-week horizon, we view quality bonds and cash as more straightforward safety plays.

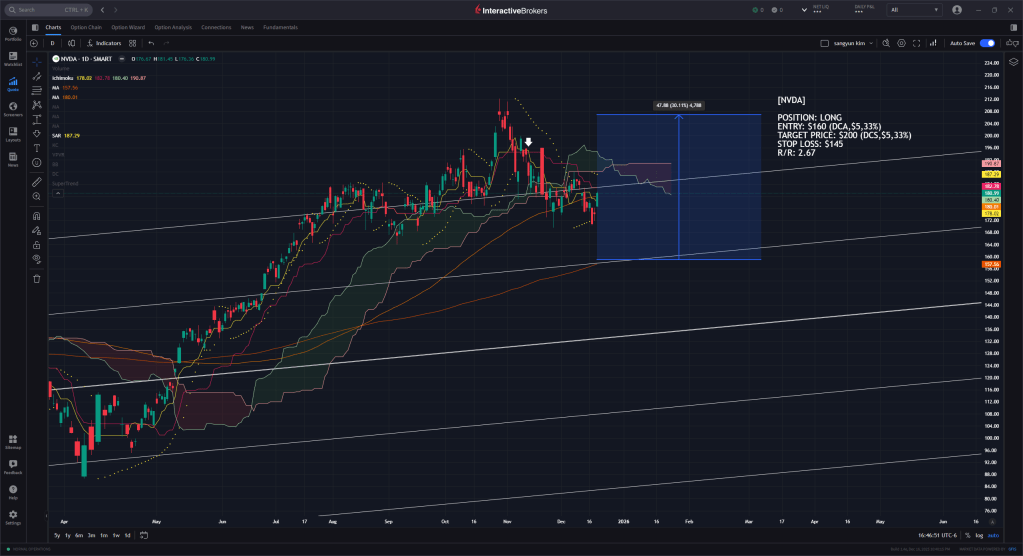

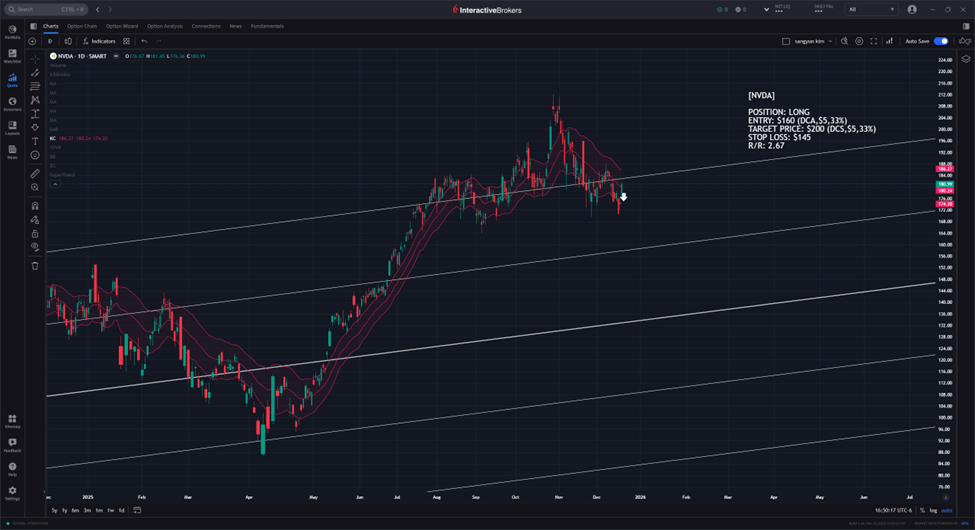

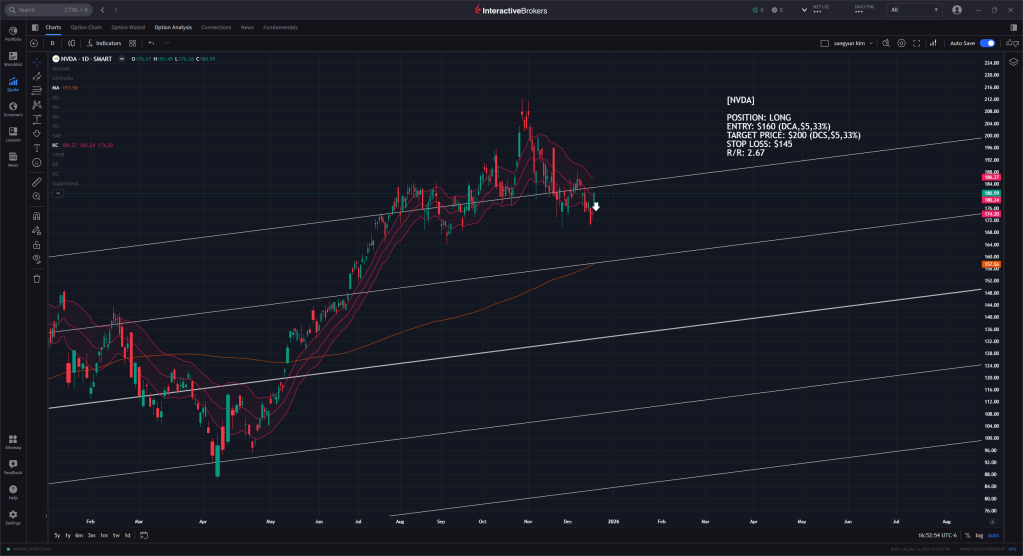

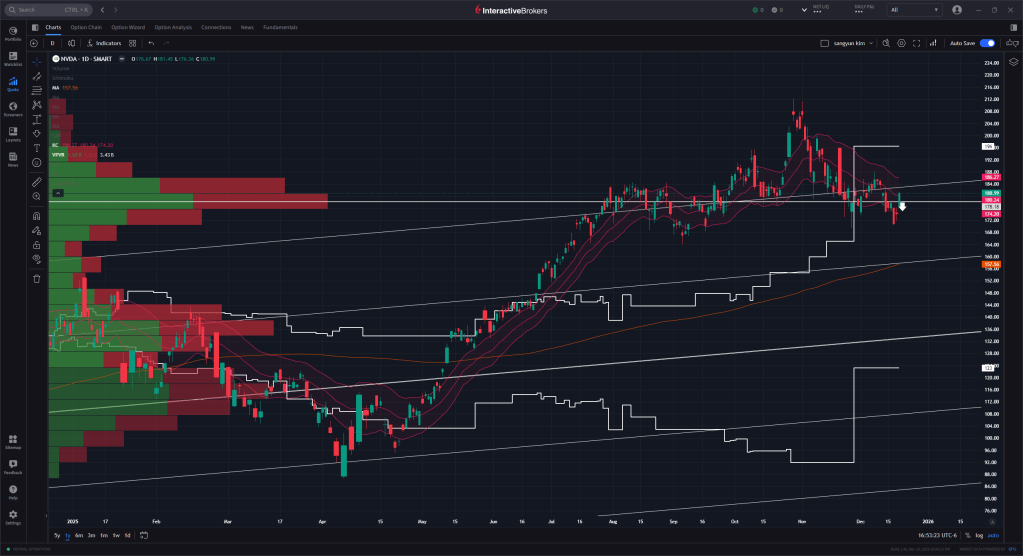

Equities and Sectors: For U.S. equities, our approach is a barbell of defensive and high-quality growth sectors, with tactical moves around the tariff news. At the start of the week, lean into defensive sectors such as Consumer Staples, Utilities, and Healthcare – these have stable cash flows and should outperform if the market turns risk-averse on geopolitical headlines. Staples and Utilities also tend to hold up in stagflationary periods (pricing power and dividend yields, respectively). Healthcare (especially big pharma) offers a similar defensive growth profile. We also like Industrials with domestic focus (like certain infrastructure and defense names) in light of the fiscal support domestically and abroad – for instance, the boost in German defense spending and U.S. infrastructure plans could benefit firms exposed to those areas. On the flip side, we would underweight or avoid sectors most vulnerable to trade disruptions early in the week. Chief among these are Autos and Semiconductors. Auto stocks (global automakers) face direct headwinds from the U.S. import tariffs – we’ve already seen auto shares tumble on the tariff announcement, and further weakness is possible until there’s clarity. Semiconductor and technology hardware companies are in a fragile spot due to U.S.-China tech tensions; any escalation could spur supply chain disruptions or export restrictions. Indeed, the semiconductor industry is grappling with both U.S. restrictions and Chinese regulatory pushback, which has shaken investor confidence in that sector.

However, after April 2, if the tariff details are roughly as expected (no major negative surprise), we would look to gradually increase exposure to cyclical and beaten-down sectors. In a scenario where markets interpret the tariff policy as manageable or negotiable, a relief rally could lift cyclicals – think Technology, Industrials, and Financials – which have lagged recently. We particularly would eye high-quality tech names on weakness; many fundamentally strong tech firms could rebound sharply if panic over trade fades. That said, any adds to these sectors should be done selectively and with tight risk management, given the still-present stagflation risk. It’s also worth noting small-cap U.S. stocks which are more domestically oriented: they have less direct exposure to tariffs (since they tend to do more business at home), so if the broader market stabilizes, small-caps could catch a bid.

Global Assets and FX: For international equity allocations, as mentioned we prefer to underweight Europe and export-focused Asia in the immediate term. Within emerging markets, we’d be selective – for example, commodity-exporters in Latin America might be more insulated from trade wars and could even benefit if China’s stimulus underpins commodity demand. But broadly, EM equities could remain volatile with a strong U.S. dollar and risk-off flows. On currencies, we anticipate the U.S. dollar to see safe-haven demand early in the week – uncertainty tends to boost the dollar, and the Fed’s relative hawkish stance (compared to a pausing ECB or cutting EM central banks) supports the greenback. Indeed, if volatility rises, the dollar could rebound from its recent dip. As such, keeping some exposure to USD (versus other currencies) or holding unhedged U.S. assets can provide a cushion. Conversely, the yen and Swiss franc might also strengthen as traditional havens – short-term traders could consider those as tactical plays around the tariff announcement. Gold is another asset to watch; it has rallied amid past tariff fears and could do so again if a risk-off wave hits. We wouldn’t chase gold too aggressively, but a small allocation as an insurance hedge makes sense given the event risk.

Fixed Income: In bonds, our preference is for high-quality and intermediate duration. With growth concerns brewing, we expect no major uptick in yields near-term; in fact, if the data disappoint or the tariff shock spooks markets, Treasuries could rally. We recommend holding core government bonds at close to benchmark weight or slightly above. Credit spreads have been relatively well-behaved, but we’d be cautious on lower-grade corporate debt for now – a stagflation scenario is not friendly to high-yield issuers. Investment-grade corporates and munis, however, look reasonable for carry given the Fed pause. Also, for those worried about inflation, TIPS provide a way to stay defensive while hedging inflation risk; breakevens have risen (reflecting inflation angst), but if you expect those to keep climbing, a TIPS position could benefit.

Summary Allocation: Put together, a balanced allocation this week might be tilted slightly defensive: e.g., 60% equities / 35% fixed income / 5% cash or equivalents for a moderate-risk investor (versus a typical 65/30/5). Within equities, favor roughly 40% U.S., 15% EAFE (Europe, Japan, etc.), 5% EM (underweighting non-U.S.). Sector-wise, overweight Defensives and select Growth (tech) later in the week; underweight Tariff-sensitive cyclicals initially. In fixed income, stick mainly to sovereign and high-grade credit, duration in the mid-range (neither too short – since the Fed likely won’t hike more – nor too long given inflation uncertainties). Keep the flexibility to adjust after the April 2 event: if a positive resolution emerges, one can rotate into more cyclical exposure quickly (adding to EM or industrials, for example, which would rebound). If instead the situation deteriorates (e.g. retaliatory tariffs, bad data), then further reduce equity exposure and add to havens like Treasuries, USD, and gold.